The Economics of MORE

Once upon a time there was a simple, ethical way for an honest ‘capitalist’ to earn money.

You would invest in a company you believed in; which provided quality goods or services for which there was a market; which was managed by people you had confidence in. Your investment would provide the company with the capital it needed to get started.

You would invest by buying shares in the company, and thus become a shareholder. The company would use your money to buy whatever it needed to produce the good or services; it employed people and earned their loyalty; it would sell to customers and make a profit. Eventually, some of this profit would be paid back to the shareholders as a dividend.

So if you bought a share for $100, and you received an annual dividend of $10, that would be a very healthy 10% return.

This was an Honest Sustainable Profit.

Let’s say it was a manufacturing company. One year it sold 10,000 units and gave you a dividend of $10. The following year it sold 11,000 units and gave you a dividend of $11. The following year it sold 12,000 units, and gave you a dividend of $12. You were content with this Honest Sustainable Profit, and with the steady growth as well.

Then the following year, there was a global downtown for reasons which were entirely outside the control of the CEO. The company sold only 9,000 units – but it still made an Honest Sustainable Profit and it gave you a dividend of $9.

-

-

-

-

This was the old model of economics, based on the actual creation of value (ie goods and services, ie real ‘stuff’). As long as you could do so profitably, there was no need to get anxious. And you would keep those shares for years, decades even. You could leave them to your children, so that they could enjoy the Honest Sustainable Profit which came from those companies.

But then, some GREEDY and CRAFTY people decided that they weren’t interested in an Honest Sustainable Profit of around 10% per year. They decided that they wanted to double or triple their money, in a very short space of time.

They figured out that they could sell the shares to some other individual, for more money than they had paid originally. They would try to sell each share, for which they had originally paid $100, to someone else for $150. In order to do this, they had to convince the potential buyer that he would later (maybe next year) be able to sell the share to yet another buyer, for even more money, say $200.

For this scheme to work, they had to find a reason WHY the shares would be worth more money next year. There had to be a reason why the share price would go up.

And the reason was GROWTH.

Now the shareholders no longer cared about Honest Sustainable Profit giving them a reliable 10% return every year. They demanded that the CEO make the company GROW, every quarter, every year. They demanded the PROSPECT of BIGGER profits next year and the year after – so that they could sell the shares to someone else on the basis of this future growth. And that buyer would only buy the shares if he thought he could find someone else who would buy them for yet more money.

Now it was no longer enough for the CEO to make an Honest Sustainable Profit every year. He had to make MORE profit every year, year after year, to drive the share price UP. So even if he managed to stay in profit despite conditions being really bad, that wasn’t good enough. He was no longer being measured on the Honest Sustainable Profit – he was being measured on the share price.

But GROWTH year-

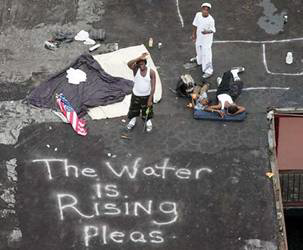

MORE consumption.

MORE destruction.

MORE waste.

MORE pollution.

Nobody asked the Earth if she could absorb unlimited growth – the economics of MORE.

And she began to feel unwell.

But this didn’t matter to these new shareholders. Once they had bought the shares

on the expectation of future GROWTH, the ONLY way for them to make a profit was to

sell the shares for MORE money. The Honest Sustainable Profit and the resulting

dividends were not going to bring any positive return. In fact, they didn’t even

care about these any more. They wanted only rapid share price appreciation and they

didn’t care what the company had to do to deliver the necessary growth – borrowing,

acquiring, over-

The CEO was being forced to put the share price before Honest Sustainable Profit, and he would do ANYTHING that would make the share price appreciate.

Then the GREEDY and CRAFTY people realized something.

It really didn’t matter whether: the company was making an Honest Sustainable Profit; whether it provided quality goods and services for which there was a market; whether it was managed by smart people with integrity. All that mattered was if the price of the ticker symbol could be made to MOVE.

They realized that they could make money from the movement of the ticker symbol. All that mattered now was movement of the share price.

The ticker symbol had become detached from the company it supposedly represented.

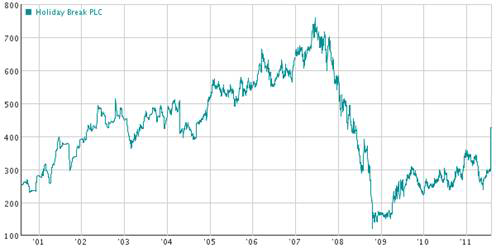

All the GREEDY and CRAFTY people needed was to create waves with the share price of XYZ. They would then ride each wave (big and small), and jump off just when it fizzled out.

Eventually, the GREEDY and CRAFTY people were using supercomputers to do all of this.

The supercomputers could track share price waves, quantify the momentum, project

how far they would go, and calculate the most profitable moment to jump off. They

made the GREEDY and CRAFTY so obscenely wealthy, they became the SUPER-

Shares would be bought and sold within days, hours, minutes, even seconds (but this was still called ‘investment’). The supercomputers became better and better at predicting the share price waves’ behavior.

The poor CEOs carried on running their companies as best they could, even firing

thousands of people and endlessly restructuring the business units, hoping to improve

the company’s share price. Every little bit of ‘news’ could be used to move the

share price, and with every movement, the SUPER-

-

During Jeff Immelt's first seven years on the job as CEO, GE's revenues increased by more than 60%, its profits doubled, but its share price languished and fell significantly According to one analyst, “GE’s just not sexy.”

-

The SUPER-

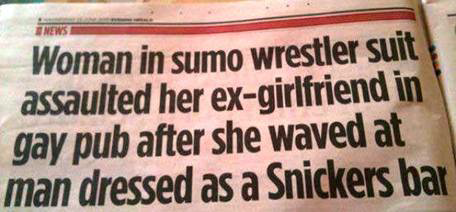

Nobody gave a damn about Honest Sustainable Profit. MOVEMENT of the share price was all that mattered. And any piece of ‘news’ which could create some movement was snatched up and broadcast widely. A whole industry sprang up to provide this ‘news’, and now everyone was giving ‘stock tips’.

But in order for the SUPER-

Enter Mr & Mrs SHEEP.

MR & Mrs SHEEP believed in concepts like ‘financial planning’, ‘taking responsibility’ and ‘investing for the future’. Mr & Mrs SHEEP were led to believe that choosing shares wisely for investment would give them a long term return. But they too had lost sight of Honest Sustainable Profit, and were confused by the illusion of share price growth – because this was how everyone seemed to be making so much money. Literally: ‘making money’. (This ‘money’ was almost completely detached from the actual performance of the companies – good or bad.)

Everyone was telling Mr & Mrs SHEEP to put their money into the market, and giving them endless advice on where to put it.

Mr & Mrs SHEEP put their money – with careful research and consideration – into the market.

But the market was no longer about Honest Sustainable Profit. It was about creating ticker symbol waves up and waves down. Riding the waves was the only way to make money – not the profit from each company. But without a supercomputer, these ‘investors’ didn’t have a chance.

They just became part of the waves which the SUPER-

Ordinary people still called this ‘investment’. They still thought they were smart. But without the supercomputers, they were just sheep.

Of course, sometimes they did make money, and it was important that they did do so. As long as they made money occasionally, they could be convinced that this was due to their own careful research and astute judgment – and so they would carry on ‘investing’.

The SUPER-

The SUPER-

Work was for ordinary people.

But the SUPER-

And then the SUPER-

The real news was completely lost.

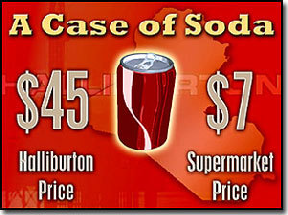

They could even control the government – taking the country to war to use weapons

which their own companies designed and produced, making themselves even more obscenely

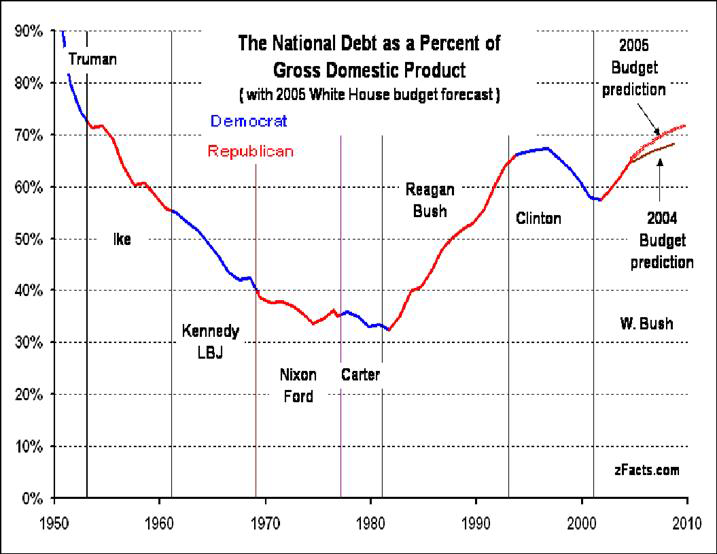

wealthy. And causing the country to over-

And then, in a supreme act of arrogance, the SUPER-

And the SUPER-

So:

Farmers grow food.

Teachers teach children.

Soldiers die for their country.

Nurses care for sick people (the ones who have insurance).

And they all pay about 30% tax.

But the SUPER-

Now the Nation is in a budgetary crisis …

But the SUPER-

And now Sports …